Event Insurance or One Day Event Insurance: Legal Terms Event Planners Need To Know

Don’t have time to read the whole guide right now?

No worries. Let me send you a copy so you can read it when it’s convenient for you. Just let me know where to send it (takes 5 seconds)

Having an event planning business is easy to start, right?

Wrong!

The legal stuff never ends and liability is always a risk. I mean look how many types of insurance there are: event insurance, wedding event insurance, special event insurance, one day event insurance, it goes on and on.

But it goes far beyond event insurance.

As a service provider, there are a number of contracts you need to become familiar with. No one is saying you have to become a lawyer but you’ll see these enough times that knowing something about these contracts will be useful.

Of course, there is no substitute for hiring a lawyer whenever presented with a legal issue.

Every state has different rules for how contracts work, what’s not enforceable, and what is enforceable.

And this is not to mention that the law can get fairly complicated on certain issues.

So don’t take anything here as legal advice (official disclaimer!). Just take this is as information to get you started.

Office Lease

Starting your own event planning business does not need to start in an office.

But at a certain point, and if things are going well, you may want to lease a commercial space.

What’s the point of paying all that money for an office, you may ask?

Once you are established enough, your clients may expect something like an office as a sign of professionalism and status. Offices are great central locations as well where employees can come in, and for storage.

So what should you look out for in an office lease?

Is your business structure in place?

Remember all that advice you got in what type of business to create? LLC, S-Corp, partnership, etc.?

Here is where all that comes into play.

If you want to be protected by the corporate shell, you’ll want to make sure you’ve incorporated your business and are keeping up with corporate formalities.

That also means that your business should exist as an LLC or S-Corp or whatever before you get started.

What’s the point?

The corporate shell protects you as an individual personally in case anything goes wrong. This is an important failsafe for you so that only your business can be liable, not you personally.

Not all business types have the same sort of protections regarding the corporate shell so even more questions to ask your attorney when you are forming your entity.

Look carefully at the term of the agreement

Are lease boring to read? Absolutely.

But you have to sift through them to really get at the heart of what you are signing.

The term may be simple in some, maybe a 3 year lease.

But there are different milestones your lease can cover.

For example, when is the move in date, when is rent due, when must you have proof of insurance by, and so forth.

This is also going to be important when booking events for your clients (whether event insurance, special event insurance, wedding event insurance, etc.)

Additionally, many leases have rent increases or rent abatements at different points during the lease.

And of course always remember that with any contract, you can negotiate!

Don’t think that just because someone presents you with a lease for 5 years that you need to be happy with that term length. Let your future landlord know (before signing!) that you want a shorter term.

Make sure to read the event insurance and other insurance requirements

Speaking of event insurance, let’s talk about event insurance.

You probably knew as an event planner that event insurance was already important and you may already have policies in place. And remember that different insurances, not just event insurance but wedding event insurance, special event insurance, and one day event insurance, have different policies.

That applies to your events but insurance is important even in just running a business!

Make sure the policies you have in place are in line with the policies required to lease.

You do not want to get stuck paying higher premiums because you did not read the lease carefully enough!

Landlords many times require you to carry basic forms of insurance such as property and general liability. But you want to make sure your policy amounts are in line with your landlord’s.

Do you have to sign a personal guarantee?

Remember how the corporate shell can protect you from personal liability?

Landlords are aware of that and want to keep you on the hook so that you don’t think you can break the lease and be protected.

They do this by generally making you sign a personal guarantee. This is essentially you taking on liability for the lease in addition to your business. But it doesn’t stop there. You can think about negotiating that the guaranty only cover a portion of the total rent amount, for example.

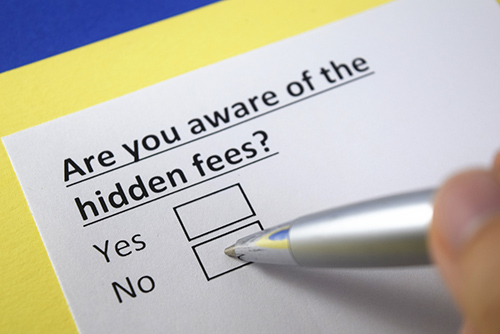

Your type of lease and fee increases

Did you think all you have to pay is rent for your office lease?

It’s a bit more complicated than that.

First, let’s review the different types of leases:

- Single Net Lease, Net Lease

- Net-Net, or Double Net Leases

- Triple Net Leases

- Full Service Gross, or Modified Gross Lease

For the purposes of this article, we’ll only focus on the full service or modified gross lease because those are the most common for multi-tenant buildings.

And unfortunately, these are the type of leases that have complicated cost splitting arrangements between you and your landlord.

You’ll split the building’s property taxes, insurance, common area maintenance (CAM), and utilities. Many times, this will be based on the percent of square footage you have compared to the rest of the building. One thing you can look out for is to make sure this percentage is based on the total square footage of the building and not based on occupancy.

So make sure you review this area because this is where your hidden costs can come in. It is likely that in such a structure, your rent can increase for the following year(s) based on increases in these operational costs. And in fact, many times your square footage does not just include your secluded office but also the common areas on your floor as well.

So do the math and figure it out how much you should be responsible for. You don’t want to be surprised in the following years due to big cost increases that your landlord has.

And once again, negotiate! For example, you can try to set up a cap to the CAM which means that your increased fees do not go above a certain amount. Additionally, you can make sure the CAM does not include things unrelated to direct building maintenance such as marketing or legal fees.

Check what your security deposit is in the lease

In a conventional residential lease, the security deposit is many times first month’s and last month’s rent.

In a commercial lease, it can get a little more complicated.

For example, a landlord can demand more than 2 months’ rent in cash.

So make sure to read this provision because it is not necessarily boilerplate.

Check to see how signage works

Since you are likely signing a lease for at least a few years, it is important to get as granular as possible.

It turns out even tiny issues can be negotiated, such as signage.

Do you want your business’s sign to be visible from the street view? Who pays for the signage and where does it go?

You should be on the lookout for these terms.

Is your lease assignable?

First off, what’s an assignment? This means that you can “assign” your rights and obligations in the lease to a third party.

What’s the difference between an assignment and a sublet?

It’s a little technical but in either case, someone else is taking over the office space.

Landlords many times will want to restrict your ability to assign or sublet your space by specifying so in the contract. This usually means that the landlord wants the last word in anyone you would find to take over the lease.

Otherwise, you would be able to assign or sublet the space to another business potentially without the landlord’s permission.

If this is too much, don’t sign a lease at all!

An office lease is a big commitment so if any of this scares you, that’s ok! You don’t need a lease.

Client Services Agreement

As an event planner, you are trying to acquire clients looking to use you to plan events. Simple enough, right?

In such situations, it’s great practice to have a contract between you and your clients.

It’s not just about having an enforceable document. It’s also about making clear everyone’s expectations about your services and responsibilities.

As opposed to the lease, you as an event planner are likely going to be the one that has to have the drafted contract ready to go. So let’s go through some terms you will want to consider having in your contract.

When do you get paid?

Since event planning contracts are over many times a considerable amount of money, you want to specify what payments you need and when you need them.

You should indicate the date in the contract for when you are to be paid.

What is indemnification anyway?

Basically, it is legally enforceable promise to defend you in case you get sued.

So what does that mean?

Well let’s say while you are dealing with a venue, something goes wrong and the venue sues you as the event planner for a client’s event.

You want to make sure you are not on the hook. After all, you were just the planner, not the client.

An indemnification clause gives you protection so that if “your client does something that causes you harm or results in a third party suing you for damages”, you are covered.

Event Cancellation

What happens if a venue closes or there’s terrible weather and the client needs to cancel the event?

That’s no good but you should be paid for the work you’ve done up to that point, right?

Well, get it in writing!

Make sure in your contract you have spelled out the parameters regarding refunds in case the event is canceled.

What is the scope of your service?

If you are an event planner, you know you’ve had the experience where a client expects too much from you.

You are not every vendor and you are not the venue. You’re the planner!

And you want this specified in the contract by going over the scope of your services.

You can even specify things you won’t do or won’t be obligated to do!

Contract with Venue

While the contract with the client may not be terribly complicated, the contract with the venue for the event becomes a bit tricky.

Already, we have three parties: event planner, client, and venue. As the event planner, you need to make sure the contract your client is signing is not terrible in your client’s disfavor.

And while you are not a lawyer, there are a lot of terms you need to be on the look out for so you can get a good deal for yourself and your client.

Attrition Clauses

For first time event planners, the word, “attrition” may seem benign. For seasoned planners, it can be a nightmare.

Attrition refers to a term in the contract which forces a penalty should you not get an adequate amount of group bookings for an event.

Here’s a basic scenario: let’s say you plan on inviting 100 people to a multi-day event. The venue will give you a group room rate for those 100 people. Here’s where attrition comes in. The venue will many times require that 80-90% of the group book an overnight room. That would mean of the 100 people invited, 80-90 people would have to book an overnight room for the event.

If you fail to get those 80-90 people to book a room, you will be charged a penalty (known as the attrition rate) by the hotel.

How this gets calculated and to what degree can get fairly complicated.

But first know that whatever the venue gives you is of course negotiable like any contractual agreement.

Second, just make sure to have the likely scenarios in mind and calculate various penalties depending on the likely scenarios.

Force Majeure Clause

Force majeure is a fancy way of referring to unforeseeable events that may, in your case, cancel an event.

These can be event such as acts of God (a legal term referring to weather like hurricanes or earthquakes), war, riots, fire, strikes, lockouts, etc.

As you can see, these can be events related to natural disasters, violent acts, or worker related issues on the part of the venue.

These clauses are especially important in areas with volatile weather but either way, you want to spell out what happens in such a situation. You don’t want any party to believe you are still on the hook for an event that cannot happen due to one of these intervening acts!

Setup, cleanup, and overtime fees

When planning your event, keep in mind that the hours you set for the event are not the only hours you need to be there.

You may need considerable set up and cleanup times. If you go past these times, many times the venue will charge an overtime fee.

All these terms should be set up in the contract and of course it is all negotiable.

One tip is to book the event for longer than you think you’ll need just to give you some cushion in case something goes wrong.

Proof of event insurance

Similar to office leases, make sure the insurance requirements make sense and that you have proof of event insurance ready to go. Event liability insurance, as we mentioned, is very important and having it available on hand is important as well.

It’s these little things that can pile up which can give you a major headache later on.

Other things to be aware of

You want to make sure that little things are addressed in the contract.

Such things can be whether the venue is handicap accessible, if security will be on the premises, and any parking restrictions or permissions.

There are lots of scenarios you may not have in mind now that you need to think of so that the contract can address them.

Don’t have time to read the whole guide right now?

No worries. Let me send you a copy so you can read it when it’s convenient for you. Just let me know where to send it (takes 5 seconds)

Conclusion

Of course, these are not all the terms that can be problematic within your contracts.

Depending on where you work or where your event is, different terms can acquire different value.

And just a reminder, we provide this just for informational purposes, not for legal advice.

No matter the case, it is always advisable to speak to an attorney who can review the contract. There’s no substitute for legal advice.

What contract terms have you found important in your office leases or event contracts? Let us know in the comments below.

Comments

Leave a comment